Content

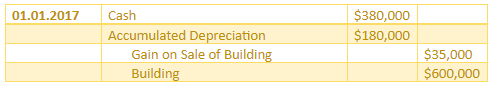

For raw materials and finished goods, the NRV would be the value expected to be realized minus selling costs of the inventory sold either individually or altogether. Under this method once the loss is determined, cost of goods sold account is debited and inventory account is credited to record the write-down loss on inventory. Under GAAP, inventory is recorded at the lower of cost or market, whereas under IFRS, inventory is recorded at the lower of cost or net realizable value. Furthermore, under GAAP, a firm need not apply the same formula in determining the cost of different inventories, even if the inventories are similar in nature and use. IFRS mandates that the same formula be applied to all inventories with a similar nature and use. In inventory, the NRV is used to allocate for the joint costs of the products prior to the split off in order to come up with the sales price of the individual products. Computing for the Net Realizable Value is important for businesses to properly bring the valuation of their inventory and accounts receivable in order as to not overstate their assets.

If you owned a shoe store, for example, and you had a pair of shoes that you believed you could sell for $40, then that would be the expected selling price. If the shoes had a list price of $40 but you believe you’d have to discount them to $30 to sell, that would be the expected price. ABC International has a green widget in inventory with a cost of $50. The cost to prepare the widget for sale is $20, so the net realizable value is $60 ($130 market value – $50 cost – $20 completion cost). Since the cost of $50 is lower than the net realizable value of $60, the company continues to record the inventory item at its $50 cost.

Accounting For Distressed Inventory

In case of accounts receivable, one uses NRV to calculate how much accounts receivable a company expects to turn into cash. An accounts receivable converts into cash when customers pay their outstanding invoices. However, an account manager must adjust the accounts receivable balance for the customers who don’t make the payment.

🌱MULTIVITAMIN🌱

KEY BENEFITS

🌱Ultimate one-a-day formula

🌱Blend of over 9 essential vitamins

🌱Includes vitamin A, B, C, D, E & K

🌱100% daily NRV for many key vitamins

🌱CBD-free productGive your body the boost it… https://t.co/gB3DChM7eR

— Naturecan (@Naturecanltd) August 4, 2020

Whether the total NRV adjustment the company will recognize in its accounting records will include this additional amount is a matter of management’s professional judgment and knowledge of the business. In essence, we do not book a decrease directly in the inventory balance. A separate credit account is where we recognize an NRV allowance. We then use this account to offset the value of inventory in our financial statements. In IFRS, we are required to present at the lower of cost and NRV. US GAAP refers to a different term, stipulating we have to show assets at the lower of cost and market value. Market value refers to the asset’s current replacement cost, and it has a defined ceiling and floor, although the floor can be subjective.

Why Nrv Is Lower Than Cost?

As estimates, companies should not expect them to be completely accurate, so they should factor in any loss of stock from damage and theft and supplement them with periodic inventories. GAAP does not approve of these methods, so accountants seldom use them. The cost of goods sold valuation is the number of units sold multiplied by the weighted average cost. A manufacturer’s inventory would be at its cost to produce the items . However, if the net realizable value of the inventory is less than the cost, the NRV will usually need to be reported on the balance sheet instead of the cost. The calculation of NRV is critical because it prevents the overstatement of the assets’ valuation.

What is a biological asset?

Biological Assets are assets that are living – for example, trees, animals, or cannabis. The balance sheet. … The International Accounting Standard 41 (IAS 41) states that a biological asset is any living plant or animal owned by the business, and they are typically measured at fair value minus selling costs.

NRV is the total amount which a company can expect while selling its assets. It is used by businesses to value their inventory and it uses a conservative approach while valuing the inventory. Analysts, who are analyzing companies financial can also check if the company is valuing its assets following proper accounting method. NRV helps businesses to assess the correct value of inventory and see if there is any negative impact on valuation. This approach expects the businesses to value their inventory at a conservative value and avoid overstating it. At year end, remaining inventory items are measured at the lower of cost or market, or LCM. This means that any items remaining are compared to the current replacement value.

Calculating Net Realizable Value For Inventories

Costs include storage space, handling the stock, the loss to the company if the items become obsolescent or deteriorated and the capital cost relating to unsold inventory. Accountants would not use the specific identification method in this example because retailers do not track snowboards with unique identification codes. Specific identification would be a good method if the company were selling snowboards that are one-of-a-kind pieces of art or collectibles from famous athletes. In these cases, tracking the physical flow of the goods is easier than in high-volume retail operations. To calculate the ending inventory in the specific identification method, tally the cost of each item in inventory at the end of the period.

Many times when posting transactions, accountants must make judgment calls. The principle of conservatism mandates that accountants select the more conservative approach when recording transactions. More specifically, the principal requires that accountants post transactions in a manner that avoids overstating the value of an asset. Net realized value provides a conservative valuation method since it is an estimate of the actual amount the seller will receive if and when the asset is sold. The very essence of cost accounting is to determine the actual costs of products in order to arrive at its sales price.

- As estimates, companies should not expect them to be completely accurate, so they should factor in any loss of stock from damage and theft and supplement them with periodic inventories.

- Since the carrying value of the machine is lower than the NRV, we will keep on reporting the machine at its carrying value.

- Similarly, recognizing inventory at the net realizable value is a departure from historical cost.

- Obtain an understanding of current and upcoming legislation that may affect the goods sold or services delivered by the company.

- Notice how he separated each purchase based on what he originally paid for them.

As our sales team offers discounts for various reasons, we also calculate the Net Sales for each item. IFRS requires applying the same assumptions and formula for the NRV calculation of similar items, while US GAAP has no such stipulation. Accounting standards require that we apply a conservatism principle when we assess the value of assets and transactions. Let’s see how companies apply this conservative rule to inventories.

Is Lower Of Cost Or Market Required By Gaap?

In the latter case, the good offsets the bad, and a write-down is only needed if the overall value is less than the overall cost. In any event, once a write-down is deemed necessary, the loss should be recognized in income and inventory should be reduced. Once reduced, the Inventory account becomes the new basis for valuation and reporting purposes going forward. GAAP does not permit a write-up of write-downs reported in a prior year, even if the value of the inventory has recovered. The Net Realizable Value or NRV is the value of an asset that a seller expects to get less the cost or expenses in selling or disposing of the asset. A company normally uses NRV for the purpose of inventory accounting and accounts receivable. Business owners understand the importance of maintaining accurate inventory records and the role these records play in inventory cost accounting.

If the current replacement value is less than the historical cost, the items are adjusted down to the replacement cost, or market, to account for the lost value. If the current replacement cost is greater than the historical cost, the items remain at historical cost, acquiring the name Lower of Cost or Market.

How Do You Calculate Cost Per Unit Inventory?

Climate-related matters could impact both the selling price and the cost of an inventory item. Therefore, management needs to consider these carefully when determining the NRV of its inventories. For Item A, the market price of $16 is within the range of the $50 ceiling and the $15 floor. Consequently, the replacement cost of $16 is compared to the historical cost of $15 to determine LCM. Because the historical cost of $15 is less than the replacement cost of $16, LCM is $15. Inventory holding costs, or carrying costs, are those related to storing unsold inventory.

- In investing, it refers to an asset’s sale price agreed upon by a willing buyer and seller, assuming both parties are knowledgable and enter the transaction freely.

- In these cases, tracking the physical flow of the goods is easier than in high-volume retail operations.

- For example if product can be sold individually and its selling price and related costs and can be determined independently then for this product LCNRV rule will be applied on individual basis.

- So it is better for a business to write off those assets once for all rather than carrying those assets which can increase the losses in the future.

- A different bead company in the area, Coastal Beads, Inc., calculated its inventory value at the end of a period using the gross profit method.

- This concept is also important tofinancial accountingin reporting inventory and accounts receivable on thebalance sheet.

- Under this method once the loss is determined, cost of goods sold account is debited and Allowance for NRV lossaccount is credited to record the write-down loss on inventory.

No value assets — assets on the balance sheet such as leasehold improvements and intangibles are not assigned any value under the liquidation approach. Inventory values can be calculated by multiplying the number of items on hand with the unit price of the items. The cost of inventory includes the cost of purchased merchandise, less discounts that are taken, plus any duties and transportation costs paid by the purchaser. Ultar Inc. makes miniature models of Karakoram peaks for tourists. Last year, sales in southern market were not promising thus entity had to write down the inventory to then prevailing NRV of 5,300. In the above method, we saw that recording LCNRV loss inventory account is credited or in simple words reduced to reflect NRV.

What Is Fair Value Accounting?

So if, say, a shoe store ships an order of 100 pairs of shoes at $40 a pair and bills the customer for payment, then it increases accounts receivable by $4,000. But if the store merely signs an agreement to ship the shoes in three months, and to bill for them at that time, nothing happens to “A/R” until the shoes actually go out the door. It is calculated by subtracting the cost of selling or disposing of the asset from its market value. The most common types of depreciation methods include straight-line, double declining balance, units of production, and sum of years digits. These schemes require a company to deliver emissions certificates to a third party – e.g. a regulator – to allow it to emit pollutants legally. In our view, a participant in a cap and trade scheme should choose an accounting policy for its emissions allowances based on one of the following approaches and apply it consistently. In addition, demand for certain products may decrease as customers shift to more climate-friendly and sustainable products, resulting in potential inventory write-downs.

Net realizable value can also be used as an alternative for market value in the accounts for valuing inventory. The inventory can either be valued at market value or historical cost. The Closing Stock or the closing inventory Formula is Opening Stock + Purchases – Cost of Goods Sold. We need to add the cost of beginning inventory or the opening inventory to the cost of purchases during the period. Then, multiply the gross profit percentage by the sales to find the required cost of goods sold. Jurisdiction and the applicable standards may also dictate the approach entity has to apply in this situation. For example International Accounting Standard 2 requires loss to be adjusted directly in the inventory account.

Though prices of inventory hardly rise again once fallen, however, in some cases inventory’s NRV may recover and rise. In such cases, entity is permitted to reverse the previously recognized loss. May be because of increase in raw material cost or other direct expenses such as royalty that is paid in foreign currency and exchange rate has fluctuated unfavorably for entity.

The basic calculation for ending inventory is the beginning inventory plus any purchases minus the cost of goods sold. The net realizable value for Bob’s General Store inventory was $88,500.

Net Realizable Value (NRV) Definition – Investopedia

Net Realizable Value (NRV) Definition.

Posted: Sun, 26 Mar 2017 00:38:27 GMT [source]

Companies average the costs of inventory and how much they sell over the period. The net realizable value method allocates joint cost on the basis of net realizable value . This method is useful in situations where one or more products cannot be sold at split-off point. Allocate the joint cost of $1,800,000 to product M and Product N using net realizable value method.

Kojamo plc’s Interim Report 1 January–30 September 2021 – GlobeNewswire

Kojamo plc’s Interim Report 1 January–30 September 2021.

Posted: Thu, 04 Nov 2021 07:00:00 GMT [source]

Because the market value of an inventory is not always available, NRV is sometimes used as a substitute for this value. Say Geyer Co. bought nrv formula 200 Rel 5 HQ Speakers five years ago for $110 each and sold 90 right off the bat, but has only sold 10 more in the past two years for $70.

When can a company write-off accounts receivable?

A write-off primarily refers to a business accounting expense reported to account for unreceived payments or losses on assets. Three common scenarios requiring a business write-off include unpaid bank loans, unpaid receivables, and losses on stored inventory.

For example, if Sunny sells sunglasses for $50 and incurs no additional selling expenses, the NRV equals the selling price of $50 as in Item A below. If Sunny estimates that each sale costs $1.18 in advertising costs, and also offers custom fitting that costs $5 per sale, the NRV equals $43.82 (50 – 1.18 – 5) . This basic formula takes into account all the inventoriable costs required to get and keep items for sale and bears on income determination. Any adjustment to inventory causes changes in the reported income.

Regardless of the method the company uses, it is most important to use the same method to present numbers year after year. This comparison has been made to determine the amount of cost of the inventory, revenue and profit. After analyzing the following table, it is understood that the cost of goods sold is $35, which is less than the NRV of $80. Therefore, in the income statement $35 is recorded as the cost of inventory. After the goods have been sold out, the company records a revenue of $100 in the books. The profit can be calculated by finding the difference between the cost of goods sold from the NRV.

Author: David Ringstrom