Content

- Where Is Unearned Revenue Recorded?

- Unearned Revenue Vs Unrecorded Revenue Explained

- Why Did The Fasb Issue A New Standard On Revenue Recognition?

- Different Parts Of Operating Activities In A Cash Flow Statement

- Example #1 Of Unearned Income

- How To Calculate Unearned Revenue With Examples

- Unearned Revenue Vs Accrued Revenue: What’s The Difference?

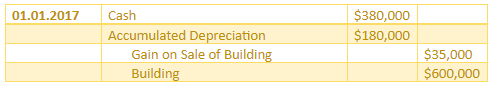

The adjusting entry has fixed both the balance sheet and the income statement. A $2,000 credit would be recorded as unearned revenue on your balance sheet under current liabilities. And since assets need to equal liabilities in the same period, you’ll also need to debit your cash account by $2,000 under current assets. Unearned revenue is recorded on a company’s balance sheet under short-term liabilities, unless the products and services will be delivered a year or more after the prepayment date. If that’s the case, unearned revenue is listed with long-term liabilities. Accounting for unearned revenue can also follow a balance sheet or income statement approach. The balance sheet approach for unearned revenue is presented at left below.

- The statement provides matching entries for the receipt of revenue from business activities, such as the provision of services, and the expenditures for the costs of performing the business activities.

- Sage 50cloud is a feature-rich accounting platform with tools for sales tracking, reporting, invoicing and payment processing and vendor, customer and employee management.

- Any business that accrues unearned revenue should record it accordingly.

- The contractor debits the cash account $500 and credits the unearned revenue account $500.

- Most of the subscription and support services are issued with annual terms resulting in unearned sales.

This doesn’t happen by accident; this debit-and-credit equality confirms the correctness of our analysis. Deferred expenses, also called prepaid expenses or accrued expenses, refer to expenses that have been paid but not yet incurred by the business. Common prepaid expenses may include monthly rent or insurance payments that have been paid in advance. Is reported as a liability, reflecting the company’s obligation to deliver product in the future. Remember, revenue cannot be recognized in the income statement until the earnings process is complete.

Where Is Unearned Revenue Recorded?

As a result, different industries use different accounting for economically similar transactions. On May 28, 2014, the FASB and the International Accounting Standards Board issued converged guidance on recognizing revenue in contracts with customers. The new guidance is a major achievement in the Boards’ joint efforts to improve this important area of financial reporting. Review all accruals posted during the quarter and ensure no manual accruals are required.

When providing disaggregated revenue disclosures, the majority of entities in our sample used two or fewer categories. The most commonly selected categories presented in tabular disclosure were product lines and geographical regions. Many entities have chosen to add a separate and specific revenue footnote that contains the required disclosures. Final credit totals existing in every revenue and gain account are closed out by recording equal and off-setting debits. Read on to find out what exactly unearned revenue is and three ways it can be good for business. Deferred revenue recognized in the three month period ended March 31, 2018 and March 31, 2017 were $38.8 million and $32.6 million, respectively.

Unearned Revenue Vs Unrecorded Revenue Explained

Retained earnings is the link between the balance sheet and the income statement. In a 3-statement model, the net income will be referenced from the income statement. Meanwhile, barring a specific thesis on dividends, dividends will be forecast as a percentage of net income based on historical trends . Examples include gift cards and software for which upfront payment implies rights to future upgrades. The Company generally has payment terms with its customers of one year or less and has elected the practical expedient applicable to such contracts not to consider the time value of money.

Based on analyst research and management guidance, we have completed the company’s income statement projections, including revenues, operating expenses, interest expense and taxes – all the way down to the company’s net income. Incremental costs for obtaining contracts subject to the scope of Accounting Standards Codification (“ASC”) 606, Revenue From Contracts With Customers that are deemed recoverable are capitalized as contract costs.

Why Did The Fasb Issue A New Standard On Revenue Recognition?

The proper recognition of expenses is important because it impacts how revenue is recorded. Under the matching principle, expenses and revenues that are related to one another should be recorded in the same period. Recognizing the expenses in the incorrect period will distort the financial statements and provide an inaccurate financial position of the entity. Under the accrual basis of accounting, recording deferred revenues and expenses can help match income and expenses to when they are earned or incurred. This helps business owners more accurately evaluate the income statement and understand the profitability of an accounting period. You report unearned revenue on your business’ balance sheet, a significant financial statement you can generate with accounting software.

An accrued expense is recognized on the books before it has been billed or paid. Receiving money before a service is fulfilled can be beneficial. The early receipt of cash flow can be used for any number of activities, such as paying interest on debt and purchasing moreinventory.

Different Parts Of Operating Activities In A Cash Flow Statement

The next chapter provides a detailed look at the adjusted trial balance. Unearned revenue is a common type of accounting issue, particularly in service-based industries.

Is revenue assets or equity?

Revenue is tangentially related to an asset. If Wal-Mart sells a prescription to a customer for $50, it might not receive the payment from the insurance company until one month later. However, it will report $50 in revenue and $50 as an asset (accounts receivable) on the balance sheet.

In this case, apply the historical ratio of amortization/purchases. The sections below summarize key categories of disclosures required under the new revenue standard and identify trends related to the Forms 10-Q that the entities in our sample filed for the first quarter of 2018. We expect entities to continue to refine the information they disclose as they review peer companies’ disclosures, accounting standard setters clarify guidance, and regulators continue to issue comments. The reporting process is then completed by the preparation of the explanatory notes that always accompany a set of financial statements. We’ll do one month of your bookkeeping and prepare a set of financial statements for you to keep. There was no impact on the Company’s financial statements as a result of adopting Topic 606 for the three months ended March 31, 2018 and 2017, or the twelve months ended December 31, 2017.

Example #1 Of Unearned Income

First, it’s important to have resources planned for the future for product and service delivery. Without them, a business may be selling something they can’t support or deliver. Revenue is one of the most important measures used by investors in assessing a company’s performance and prospects. However, previous revenue recognition guidance differs in Generally Accepted Accounting Principles and International Financial Reporting Standards —and many believe both standards were in need of improvement. Salaries Payable – The posting of salaries, wages, and benefits to the labor ledger and the general ledger occurs when each payroll is closed. However, since the cash has not been paid out, the offset for payroll expenses is recorded as a salaries payable accrual.

- By treating it as a liability for accounting purposes, you can keep the books balanced.

- Compare fixed vs. variable costs and see fixed costs examples in business.

- Most entities in our sample elected to adopt the new revenue standard by using the modified retrospective approach.

- The client gives the contractor a $500 prepayment before any work is done.

- This is why unearned revenue is recorded as an equal decrease in unearned revenue and increase in revenue .

It is the company’s liability since the amount has been acquired for the goods or service which the company had not yet provided. Report a reconciling item on the GWFS — Reconciliation of the balance sheet to the statement of net position for revenues earned but not available.

How To Calculate Unearned Revenue With Examples

Cash received for services that have not been provided is not considered true revenue until the income is earned. If a publishing company accepts $1,200 for a one-year subscription, the amount is recorded as an increase in cash and an increase in unearned revenue. Both are balance sheet accounts, so the transaction does not immediately affect the income statement. If it is a monthly publication, as each periodical is delivered, the liability or unearned revenue is reduced by $100 ($1,200 divided by 12 months) while revenue is increased by the same amount. Disclosure Examples 1 and 2 below demonstrate the use of a tabular format to disclose the impact on each financial statement line item in the current period under the modified retrospective method. We observed that many entities in our sample used a heading such as “As Reported” to refer to the balances reported on the current-period (i.e., the period ended March 31, 2018) balance sheet or income statement.

Of the entities that disclosed the contract balances in a tabular format, approximately 30 percent included a rollforward. The amount of revenue recognized in the reporting period from the beginning contract liability balance. Explain the need for an adjusting entry in the reporting of unearned revenue and be able to prepare that adjustment. Bench gives you a dedicated bookkeeper supported by a team of knowledgeable unearned revenue is reported in the financial statements as: small business experts. We’re here to take the guesswork out of running your own business—for good. Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month. Presently, GAAP has complex, detailed, and disparate revenue recognition requirements for specific transactions and industries including, for example, software and real estate.

Unearned Revenue Vs Accrued Revenue: What’s The Difference?

Disclosure Examples 9 through 11 below illustrate disclosures about performance obligations. Our clients are billed based on fee schedules that are agreed upon in each customer contract. Receivables from customers were $ billion at Jan. 1, 2018 and $ billion at March 31, 2018. An allowance is maintained for accounts receivables which is generally based on the number of days outstanding. Adjustments to the allowance are recorded in other expense in the consolidated income statement.

At the time of purchase, such prepaid amounts represent future economic benefits that are acquired in exchange for cash payments. This means that adjustments are needed to reduce the asset account and transfer the consumption of the asset’s cost to an appropriate expense account. Examples Of Unearned Revenue Journal EntriesUnearned Revenue refers to money that has been received but has yet to be delivered in the form of goods or services. It cannot be considered as revenue until the goods or services are delivered, according to the revenue recognition concept.

Annual Report (Form 10-K) – marketscreener.com

Annual Report (Form 10-K).

Posted: Wed, 03 Nov 2021 07:00:00 GMT [source]

Although we observed some consistency in their disclosures, companies’ interpretations of the requirements and the amount of information to disclose have varied. However, we expect diversity in practice to lessen as more entities adopt the standard and as entities evaluate their peers’ filings. Further, as accounting standard setters clarify guidance and regulators issue more comments, entities will continue to refine the information they disclose.

What account is unearned revenue?

Unearned revenue is an account in financial accounting. It’s considered a liability, or an amount a business owes. It’s categorized as a current liability on a business’s balance sheet, a common financial statement in accounting.

An accrual refers to an entry made in the books of accounts related to the recording of revenue or expense paid without any exchange of cash. Note, accruals impact both the income statement and the balance sheet.

Author: Roman Kepczyk